About Paytient - Our Vision

What does Paytient do? #

We enable employees to pay out-of-pocket healthcare expenses over time at no cost.

What is the problem we’re solving? What is our vision? #

We see unequal opportunity in two timeframes: Present and Future

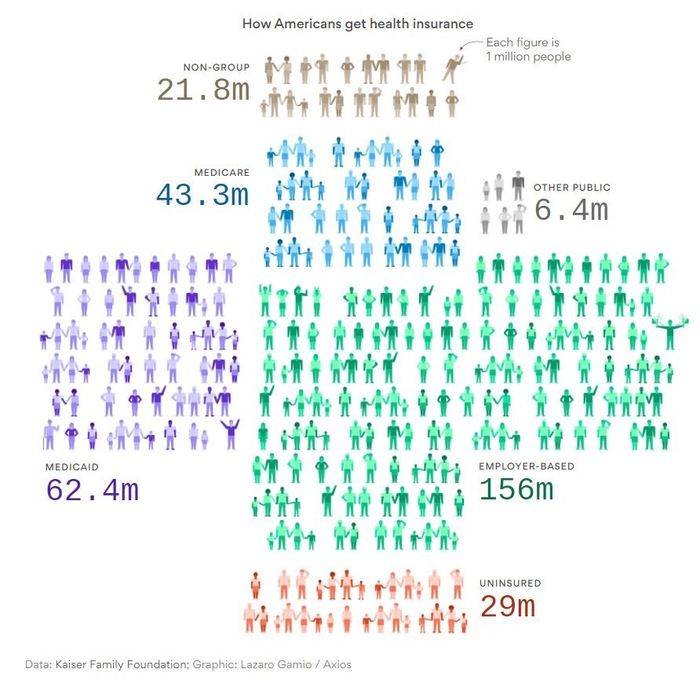

Today: If you’re under 65, it is likely you are one of the 156M Americans with health care mostly provided by their employer.

Less able to actively manage external healthcare pricing versus other operating costs, employers will continue to externalize this burden to employees via benefit plan design (networks, higher deductibles, copays, and coinsurance). This may slow, but it won’t stop as we effectively, slow-step employer-sponsored health care from largely a defined-benefit to a defined-contribution program.

As a hospital administrator for the last 11 years, I can tell you that healthcare prices, for various reasons, will continue to rise without regard to affordability. However, the average US consumer can only absorb so much, and with record levels of non-mortgage consumer debt, financial harm looms on the horizon when illness strikes. Paytient gives the US consumer a new source of no-cost funds to pay for $300B of out-of-pocket healthcare expenses.

Effectively, we’re giving people a better way to afford the status quo. But the real opportunity is over the horizon.

Future: In societal terms, perhaps somewhat counterintuitively, we believe the transition from defined benefit to defined contribution is a good thing and will inevitably result in a cash market for sub-catastrophic healthcare.

For a historical analogy, we believe the future will follow retirement savings. Before 1978, the unquestioned status quo for the way you saved for retirement was the pension plan. That changed with the advent of the 401k in 1978. 12 years later there were 20 million 401k accounts.

Interestingly, in 2016, 12 years after the HSA was created in the 2003 Medicare Modernization Act, there are 20 million health savings accounts.

It is our belief that the arc naturally bends, over time, from defined benefit to defined contribution.

Given that most healthcare transactions are sub-catastrophic, in that future, most health care transactions will be financed rather than pre-paid via third parties (aka insurance).

What does Paytient make? #

In the simplest terms, Paytient is an app to pay medical bills.

Most hospitals allow their own employees to pay their medical bills over time via payroll deduct. This was a popular way to pay at my hospital of 2,000 employees. Paytient enables all employers to offer that unique benefit to their own employees.

Sold to employers, Paytient is a digital payment method that replaces cash, credit cards, loans, or negotiating/setting up payment plans with healthcare providers.

Employees tap the app when they get any healthcare or veterinary bill. We give them access to a line of credit on a virtual payment card based on their employment history and historical net paycheck amount. After use, the app prompts them to pick the number of paychecks to pay that transaction back to us – at no cost to them. We communicate the request to the employer’s payroll team (or contracted payroll service provider) and they send us the scheduled payments.

Healthcare providers benefit from upfront payment, reduced risk of nonpayment, and incremental patient volume.

Employers benefit from a 30% increase in retention among employees that use Paytient as well as from cost reductions achieved by the paired offering of Paytient in a strategic manner.

Self-funded employers and health plans benefit from the ability to offer higher deductible plans without the financial anxiety and harm they can cause.

Why did you start this company or project? #

a) To help people access healthcare when they need it as opposed to when they are able to afford a visit.

b) Help health care providers get paid (this is a real pain point with hospitals collecting 30-40 cents on the dollar from patients).

c) Give employers a new, non-insurance tool to reduce cost as well as attract and retain employees.

d) It is our long-term view, a cash market for sub-catastrophic healthcare will arise as employer-sponsored healthcare continues to bend from defined benefit to defined contribution. We seek to establish Paytient as a new category of payer and work-place benefit in this future state.

What excites you about Paytient? #

The opportunity to improve how people buy healthcare at scale.

We also believe there are several mega-societal trends converging that make this a particularly interesting and impactful time.

1) Healthcare will only get more expensive and healthcare providers will continue to rethink and improve their revenue cycle

2) Consumers are indebted and looking for friendlier, easier to use/understand sources of funds

3) The digitization of payments

4) The disruption of the paycheck – it hasn’t substantially changed since the Victory tax and withholding were created due to WWII.